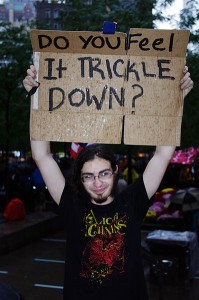

Americans Participating in Occupy Wall Street

Election years roll around and politicians on both sides promise to improve the economy. Some like Bill Clinton and Franklin D. Roosevelt have pulled it off, others not so much. It’s to be expected that economies, national and global, will fluctuate. Kinda like your wallet; every now and then you stick your hand in and wonder where all the money went.

Not since the marches against the Vietnam War and the Civil Rights Movement have Americans rallied across cities and states, filling streets to ensure their voices are heard. Picket signs in hand and slogans covering the landscape, Americans participating in Occupy Wall Street are prepared to stay the course, sleeping outdoors beneath the sky. But did Occupy Wall Street start a few weeks ago, with the market and mortgage crashes of 2007 or earlier?

Trickle Down Economics Working or Not?

Ronald Reagan is famous for introducing “trickle down” economics. Premise for the economics was that offering tax cuts to the wealthiest Americans would improve middle class America’s financial situation. The tax cuts were expected to incent the wealthy to create more jobs that paid higher wages for the working class. In 1963 wealthy Americans had a whopping 91 percent income tax rate. Clearly something had to be done. John F. Kennedy initiated tax cuts as part of the Revenue Act of 1964. In effort to revive the economy, Ronald Reagan slashed taxes as part of the Economic Recovery Tax Act of 1981. The tax rate on the wealthiest Americans would dip to 28 percent during 1988 and 1989. Bill Clinton increased the tax rate and kept it steady at 39.6 percent. In 2003, under George W. Bush, the tax rate dropped to 35 percent.

To try to stimulate job growth, President Barack Obama has recommended cutting away $800 billion in tax cuts for the wealthy and an additional $400 billion in deductions the wealthiest Americans can claim. Nearly $300 billion would be slashed from corporate deductions, $248 billion from Medicare and $72 billion from Medicaid. As a side note, if the government shut down illegal Medicare payments to bogus medical firms, it might recoup $248 billion or more. But that’s another point. An additional $1.1 trillion is expected to be saved by ending the wars in Iraq and Afghanistan.

Widening Gap Between Rich and Poor

Despite its intent, “trickle down” economics has not achieved its goal. In its October 1, 2010 “Great Recession Pushes Gap Between Rich and Poor to Record Levels” article Yahoo! Finance reports that the wealthiest 20 percent of Americans receive 50.3 percent “of all income generated in the country.” People below the poverty line received 3.4 percent of all income generated in the country.

It’s not just a national issue. In America and abroad the gap between the wealthiest people and the poor has widened. In fact, the International Monetary Fund, an organization comprised of members from 187 countries, reports that the “richest 1 percent of people in the world receive nearly 14 percent of global income while the poorest 20 percent receive just over 1 percent.”

Great Opportunities to Realize Dreams and Rise

It’s not as though people have taken to the streets to demand hand outs. And certainly intelligence would not ask that companies suffer simply because they’re big. After all, fact is that many big companies and more than a few wealthy Americans didn’t start out that way. Some big companies like Microsoft and Apple were started out of garages. Others like Nordstrom and Whole Foods Market were founded by people who scarcely had $20 to their name. People like Oprah, Leonardo Del Vecchio, Steve Jobs, Madam C. J. Walker and John H. Johnson used their passions, worked tirelessly and/or connected deeply with others to build wealth.

Hoping that people with wealth will one day join the ranks of those who are struggling financially is not what folks are occupying Wall Street for. They simply want equitable laws and rules, a chance to pull up and come out from under the economic downturn that has been taking place across the country for several years. They want politicians to stop working for big corporations and lobbyists and start working equally as hard for “every” American. They don’t want tax laws to coddle the wealthy. They also don’t want to wait until the richest Americans grow holes in their wallets, allowing coins and dollar bills to slip out, trickling down on the masses.

Check out Love Pour Over Me and Spiral at www.chistell.com

Sources:

http://occupywallst.org (Occupy Wall Street)

http://www.faireconomy.org/research/TrickleDown.html (United for a Fair Economy)

http://blogs.wsj.com/economics/2009/06/30/trickle-down-economics-fails-to-deliver-as-promised (Wall Street Journal: Trickle-Down Economics Fails to Deliver as Promised)

http://www.nytimes.com/2007/04/12/business/12scene.html (New York Times: In the Real World of Work and Wages, Trickle-Down Theories Don’t Hold Up)

http://www.washingtontimes.com/news/2010/jun/20/cbo-rich-got-richer-paid-more-taxes-under-bush/?page=all (Washington Times: Rich Got Richer, Paid More Taxes Under Bush)

http://www.taxfoundation.org/news/show/323.html (Tax Foundation: Comparing the Kennedy, Reagan and Bush Tax Cuts)

http://www.bloomberg.com/news/2011-01-18/rich-americans-raise-consumer-spending-with-little-help-from-middle-class.html (Bloomberg: Rich Americans Raise Consumer Spending with Little Help from Middle Class)

http://www.imf.org/external/pubs/ft/survey/so/2011/new091211a.htm (International Monetary Fund: F&D Spotlights Widening Gap Between Rich and Poor)

Pingback: Occupy Wall Street for Real Economic Reform | Write Money … | Top Celebrity

Pingback: Saving Money at the Gasoline Pump | Write Money Incorporated